A trophy for each category

The Best European Funds in different categories.

The Best Asset Managers depending on their size of product range.

The Best European A.M. on the long term (7 years) : FUNDCLASS trophies.

Best Funds

Funds are rewarded for the regularity of their over-performance during 4 years.

In each category of funds, we classify the open-ended investment funds, without any attention on the geographical zone, sector or type, that are represented in another category. Only open-ended investment funds without geographical, sectorial or management styles bias are selected.

Categories

The Best Funds having presented the following risk profiles:

- Europe Value Equities

- Europe Growth Equities

- US Value Equities

- US Growth Equities

- International Value Equities

- International Growth Equities

- Emerging Markets Equities

Best Asset Managers

Asset managers are rewarded by country for the global quality of their European range of funds.

The country is determined by the most important registered place of theirs range of funds.

If the range of funds is equally registered in two or more countries, the Asset Managers will compete in Multi-Country Category. The best Asset Managers in Europe are rewarded only one time as the Best European Asset Managers and doesn't appear on National Categories.

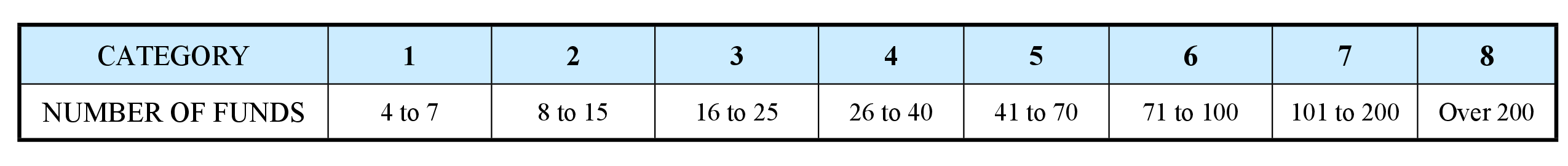

The Best European and National Asset Management companies belongs to the 8 following categories having between:

- 4 to 7 rated funds

- 8 to 15 rated funds

- 16 to 25 rated funds

- 26 to 40 rated funds

- 41 to 70 rated funds

- 71 to 100 rated funds

- 101 to 200 rated funds

- More than 200 rated funds

FUNDCLASS Trophies

This trophy rewards a long-term management, the capacity of an Asset Manager to have a range of funds that out-performs during 7 years in Europe.

Categories are the same that for the Best Asset Managers trophies.

Methodology for the winners selection

For the winners selection, we use a methodology that consists of three steps:

- Ranking of funds

- Rating of funds

- Rating of Asset Managers

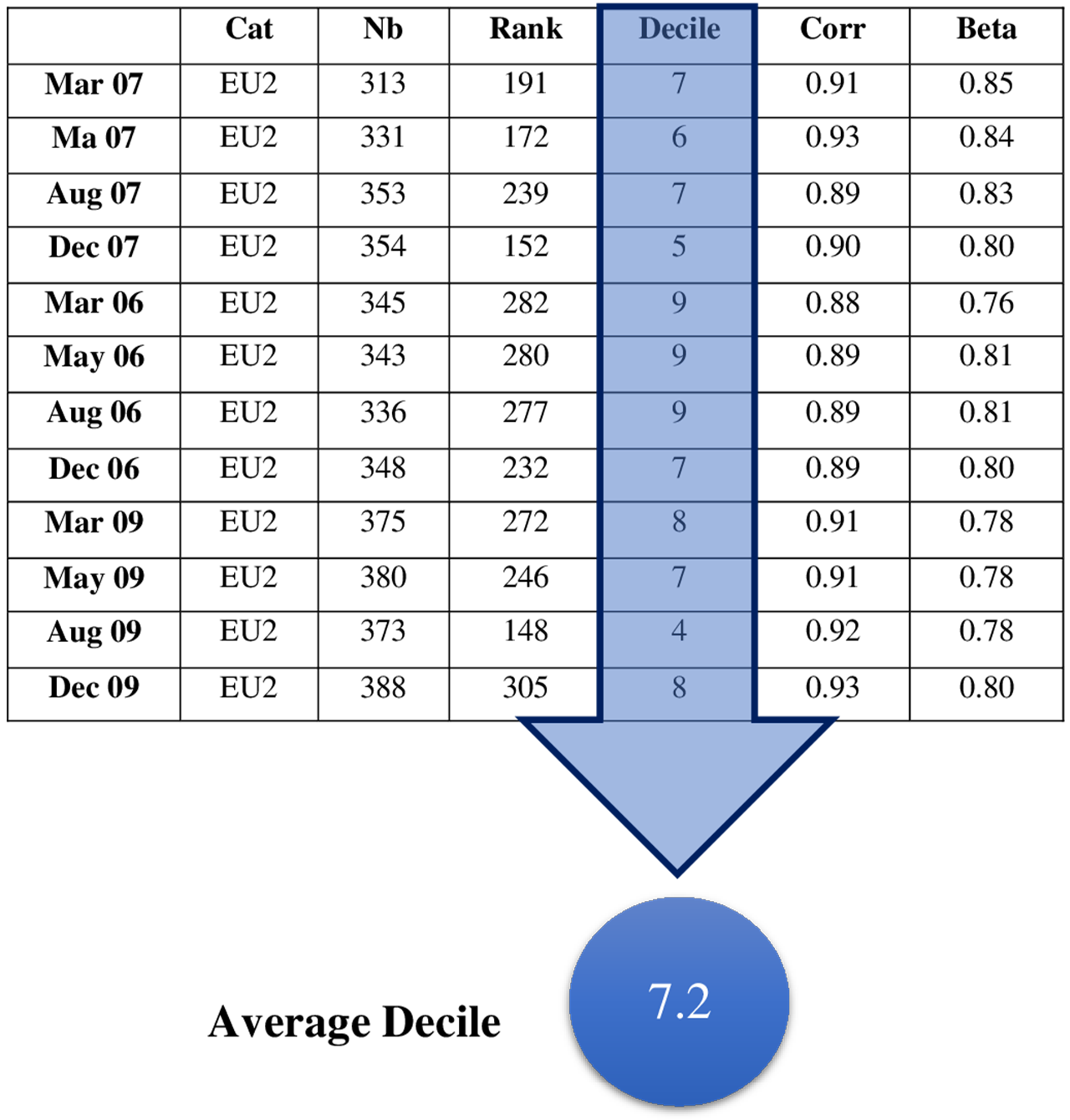

Ranking of funds

FUNDCLASS offers an objective analysis of risk and fund performance which lead to a perceptive ranking of the totality of funds available on the market. Performance achieved by one fund depends on the underlying strategy and consequently on the risks which are embedded. Risk profile for each fund are computed thanks to the APT tools and data of the FIS group.

Approximately, 210 homogeneous categories are needed to cover all type of risk profile.

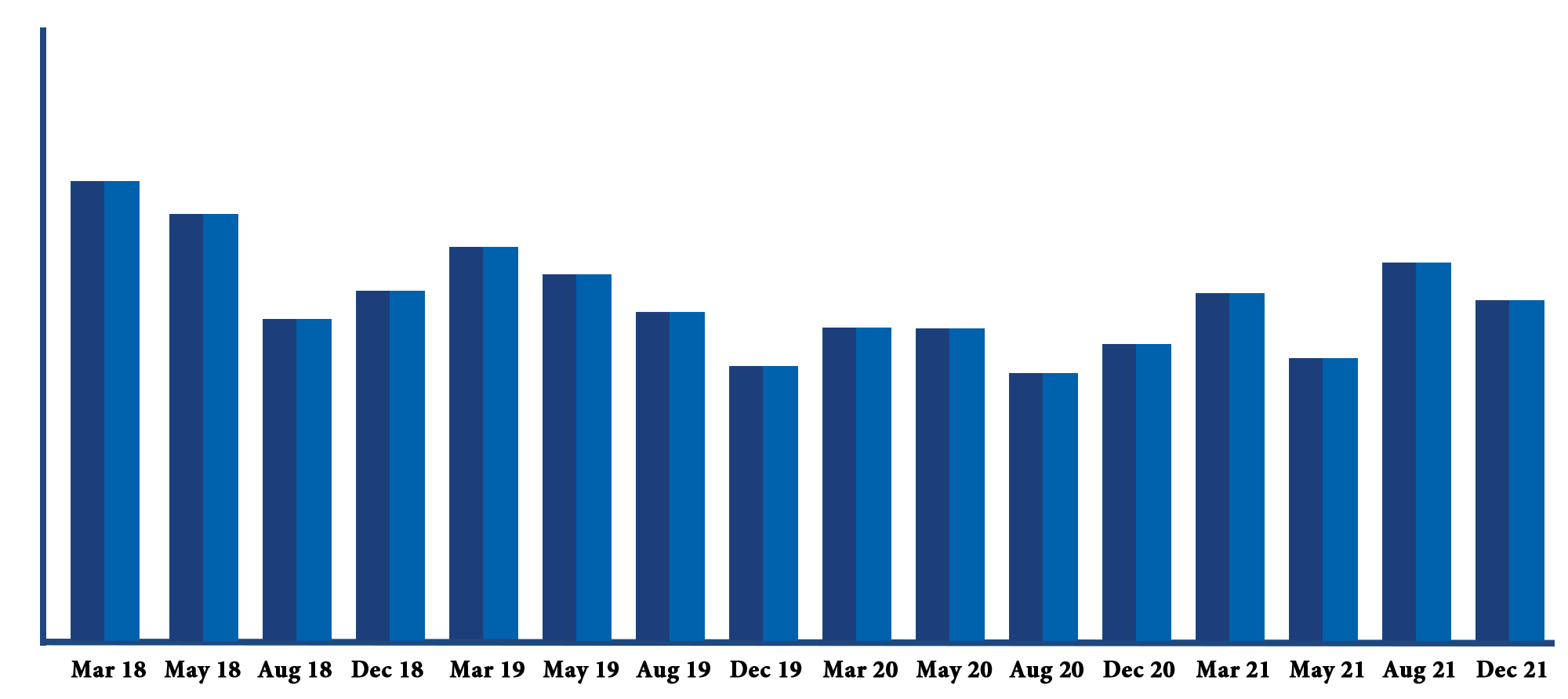

Ranking takes into account the risk level born by the investor. We compute the ranking of funds based on the Risk Adjusted Performance (RAP) of each category. Performance is compared with competitors rather than benchmarks. The process is done every quarter and stored for each fund.

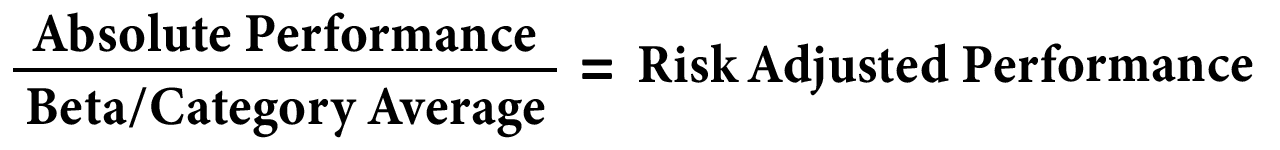

Inside a category, the RAP of each fund is:

Performance and RAP are evaluated on a one year period.

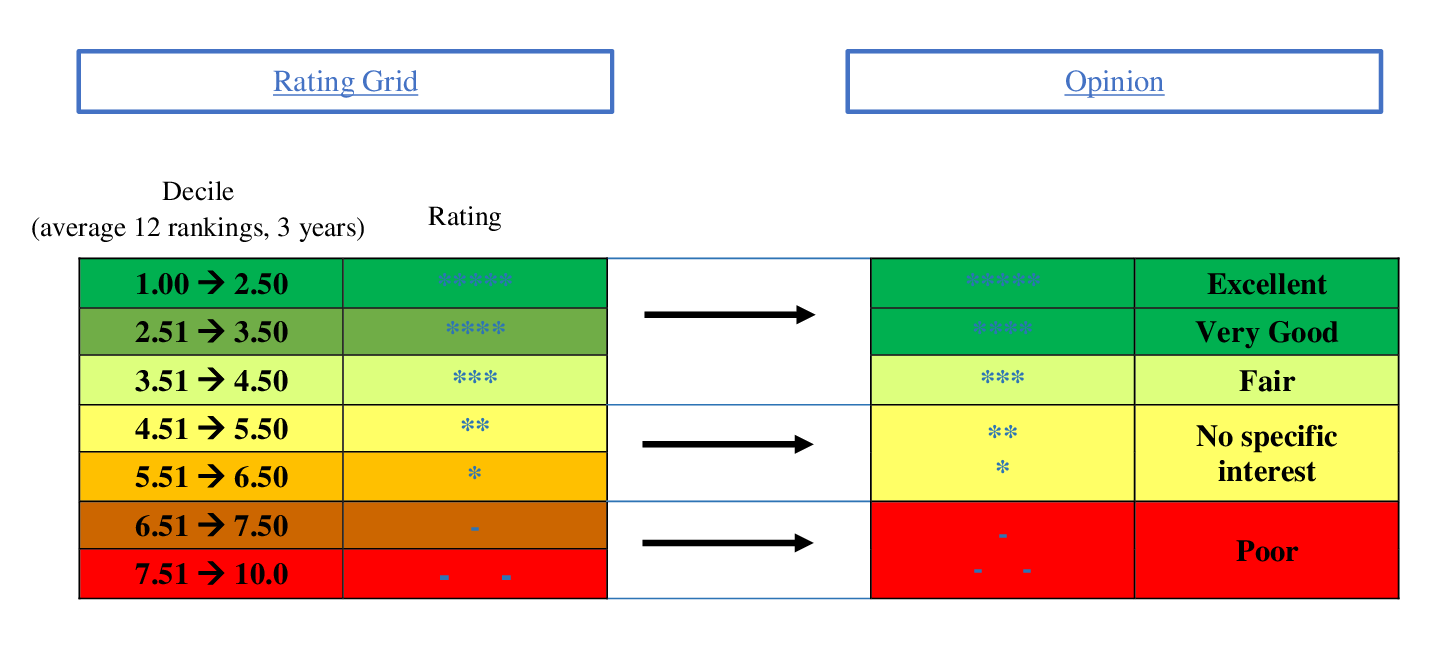

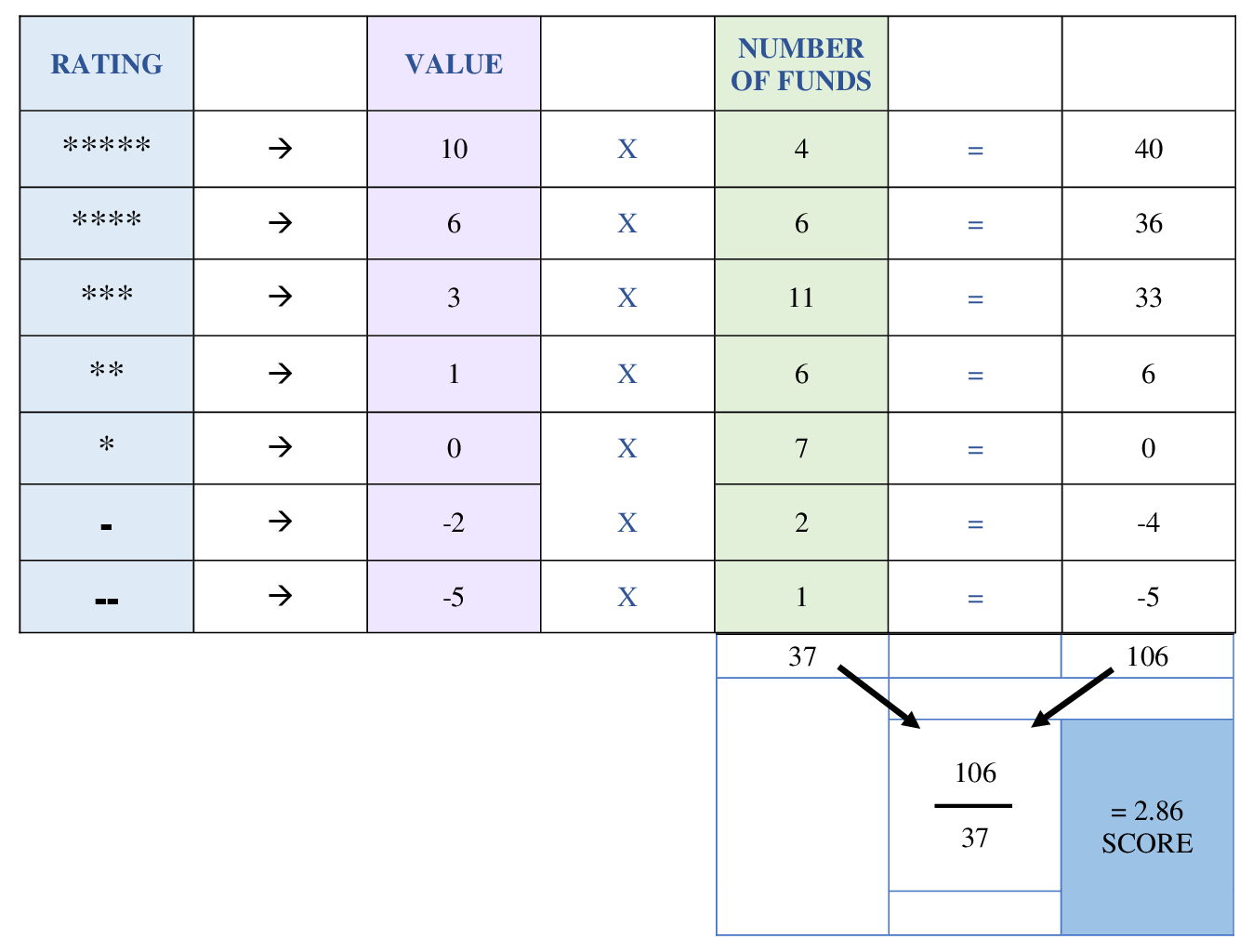

Rating of Asset Managers

Every European Asset Manager having a rated fund is rated. In order to create coherent groups, categories are defined by number of rated funds.

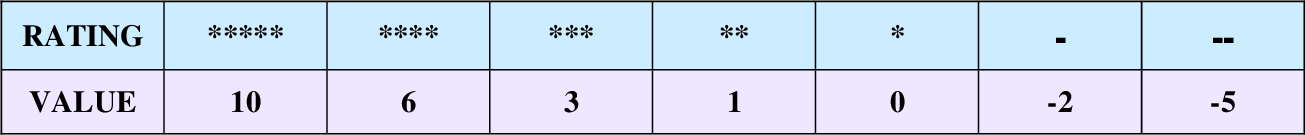

Scale evaluation for rating funds :

Considering the entire set of funds rated for one Asset Manager, we calculate its corresponding weighted average value :

We compute the average mark of all Asset Managers and define 8 categories according to the number of funds held :

In each category, the European winner is the Asset Manager with the highest average mark.